Smart ATMs offer new opportunities to significantly improve customer satisfaction levels by letting customers securely do more during each interaction.

ATMs have rapidly grown to become the key channel of connection between the financial institutions. Customers now expect ATMs to function seamlessly round-the-clock throughout the year. Considering the number of transactions that take place at ATMs and how much business that is conducted, it is important that one work to maximize the ATM customer experience, and make it consistent with the overall bank brand identity.

Over the past couple of years, we have seen a major shift in digital banking services. Personalization is not a new concept anymore. In fact, it is key for both retail and digital customer experience. As ATM is considered to be an essential part of a bank’s digital services strategy, banks need to add more services to their ATMs and expand personalized services.

Making ATMs Smarter:

Changing customer expectations and increasing market competition is pushing banks to offer innovative experiences that engage and retail customers to build long-term loyalty. Besides other digital channels such as mobile wallets and internet banking, smart ATMs offer a unique opportunity to enhance the customer experience at ATMs.

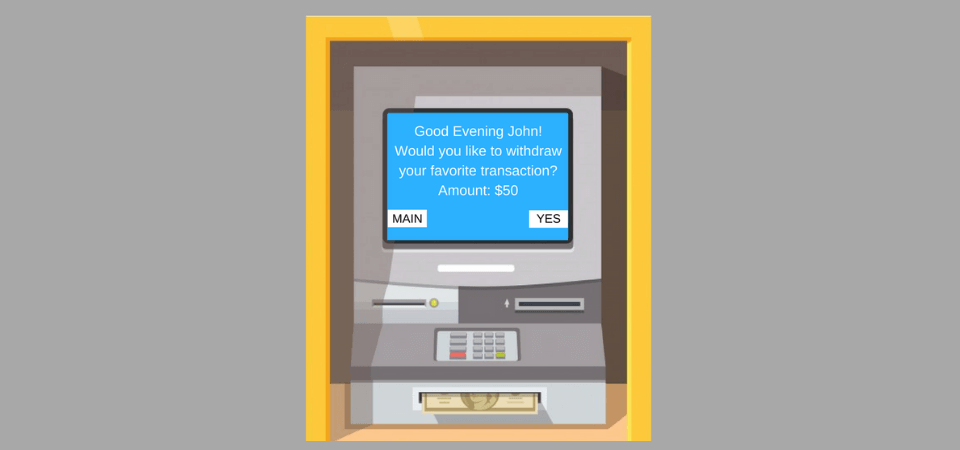

Based on customer usage trends and preferences, smart ATM features give a personalized experience to customers. These features give each ATM terminal a specific personality based on location, time of day, and even by potential relationship with customers. Each transaction is considered as an opportunity to have a personal conversation with customers. As a result, ATMs can predict customer’s favorite transactions for quick cash withdrawal and send targeted ATM marketing campaigns. These features include:

Personalized ATM Campaigns:

Smart ATMs allow customers to set their preferences that can be applied to the ATM screen. This also enables banks to launch personalized marketing campaigns for a better user experience.

Cross-Channel Services:

Along with cash withdrawals and deposits, smart ATMs allow customers to apply for loan, make bill payments, top-up mobile phone, transfer funds, donate money to charity and more.

Integration with Smartphone:

There are increasing numbers of implementations across the globe where customers just use their smartphone app to initiate cardless cash withdrawal from the ATMs. This replaces the need to carry plastic all the time. However, banks need to have a powerful payment platform in place that can drive and integrate its digital channels.

Biometric Withdrawals:

Biometric features such as fingerprint readers and voice recognition combined with two-factor authentication, give customers greater peace of mind when using ATMs.

Favorite Transactions:

Instead of being dumb terminals smart ATMs predict customers’ most frequent transactions, reducing the number of clicks required before cash withdrawal. Data analytics allows ATMs to move from ‘What do you want me to do for you?’, to predict and rather ask ‘Would you like to perform the usual withdrawal of $20 from your current account, with an e-mail receipt?’.

Frictionless ATM Experience with Remote Management:

Banks need to have a comprehensive ATM acquiring solution in place that offers comprehensive management and operations support. Small investments in ATM monitoring technology can yield significant benefits. Remote management not only provides a 24/7 visibility of the entire network but also pinpointing areas of concern before they turn into brand problems. With effective remote management downtime and service visits can be reduced significantly.

ATMs powered by TPS:

The ATM driving solution powered by IRIS Payment Platform offers comprehensive management and operations support to banks and payment processors. IRIS is a robust routing and authorization platform which enables the processing of both card and non-card based transactions acquired through the ATM network. It also offers back-office processing as well as monitoring and testing services. Following are some of the key capabilities offered by the solution:

Integration with ATM vendors:

IRIS provides the ability to manage all types of ATM devices, including NCR, Diebold, Wincor, GRG, King Teller and others. It also provides options to remotely manage ATM-related activities on an ATM terminal directly from a web interface. Users can navigate to individual items to take action based on their role and their permissions.

ATM devices can easily integrate with external systems for processing of transactions. These transactions include cash and cheque deposits, fund transfers, bill payments, remittance, mobile top-ups, as well as mobile and web-initiated transactions such as card-less cash withdrawal.

Integration with Payment Schemes:

The solution provides reconciliation, clearing and settlement support for regional as well as international card schemes including American Express, JCB, MasterCard, Visa, Union Pay and many others. It complies with all mandated requirements of each scheme’s security standards such as PIN security and EMV.

Technology Assisted Security for a Secure Customer Experience:

With IRIS multi-channel payment platform banks can adopt ATM controller based biometric authentication system. The solution enables ATMs to transmit biometric data directly through the existing middleware switch for authentication from biometric host. This eliminates the need of having an intermediary system for biometric data transmission, reducing the complexities in transaction flow as well as the scope of PCIDSS compliance for a bank. Furthermore, banks can have the flexibility to offer new, innovative biometrically enabled services on all leading brands of ATMs. The future-proof and scalable solution allows banks to develop additional biometric authentication methods over ATMs including iris and voice recognition.

Security and Compliance:

The solution is PA DSS compliant, and is designed to ensure compliance with Payment Card Industry (PCI) standards, meeting most demanding security requirements and ensuring that data is fully protected. Furthermore, the solution also enables several risk management procedures for prevention and control of fraudulent activities. Following are some of the risk management controls that come with the solution:

- Transaction rule-based blocking engine

- Account linking and delinking alerts

- Account card and operations alerts

- Personalization alerts

Smart ATMs:

In addition to basic transactions like cash withdrawals, fund transfer and bill payments, IRIS also provides smart ATM features to give a personalized experience to customers, elevating ATM customer experience to the next level. Smart ATM features include:

- Personalized marketing campaigns

- Cross-channel services

- Personalized ATM interface

- Favorite transaction for single click cash withdrawal

- Language preference

- Special and personalized greetings

Leave A Comment