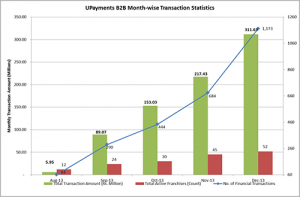

Karachi, January 23, 2014: Another milestone has been achieved in mobile banking, where Ufone following its vision of continuous innovation, has launched a new service for corporate sector in collaboration with its partner bank, HBL. Backed by TPS technology, UPayments Business to Business (B2B) service allows corporate users to carry out a range of financial transactions conveniently and efficiently via the unique UPayments platform. This 24/7 service brings much needed convenience to franchise representatives who are no more bound by bank timings to make their daily payments. In the initial phase, over 90 Ufone franchises have come onboard to utilize this service for their daily payments. Launched in August 13, within a span of few months the service processes over 300 million rupees worth of transactions a month.

| Figure: UPayments Business to Business service month-wise statistics since launch |

Small retailers and distributors will benefit greatly with this new service since they operate at the bottom of the payments cycle. Corporations in these markets now have the opportunity to leverage mobile infrastructure to eliminate inefficiencies in their payments processes and make substantial cost savings.

The registration process is easy where both Ufone and the franchise need to have an account in the partner bank, i.e. HBL, and the franchise representative can register a mobile number on the UPayments service. Once that is complete, transactions can be made using a separate USSD code for corporate payments. This service uses IRIS running at Ufone end which directly communicates with the switch at the HBL end.

The next phase will include extension of this service to include consumer to business (C2B) payments where this service will be available to the general public to make daily payments to businesses such as restaurants, hospitals etc using mobiles. As a whole UPayments platform, using TPS solution IRIS processes over 3 billion rupees worth of transactions in a month which translates to over 100 million rupees of daily transaction volume including Funds Transfer, Interbank Funds Transfer, Utility Bill and telco payments.

TPS is always enthusiastic to do innovative projects with its clients and partners that revolutionize the e-payments landscape. We believe corporate mobile payments can offer significant benefits and cost savings for those that adopt them and also act as a driver for the mobile payments industry – Shahzad Shahid, Chief Marketing Officer, TPS

We are proud to be the first bank which has initiated this project with Ufone and look forward to providing convenience of B2B payments to small businesses in the long run. We are committed to offer a scalable mobile platform to service a wide range of clients from individual customers to the largest multinationals – Nauman K. Dar, President & CEO, HBL

UPayments platform has grown exponentially over the years and this new service addition will surely attract attention of the corporate sector. Due to our strong and accurate alignments in the financial industry we have been able to provide integrated payments services, we at Ufone realize that providing mobile solutions to the banked business community is as important as financial inclusion through branchless banking. – Asher Yaqub, Chief Commercial Officer, Ufone